Anúncios

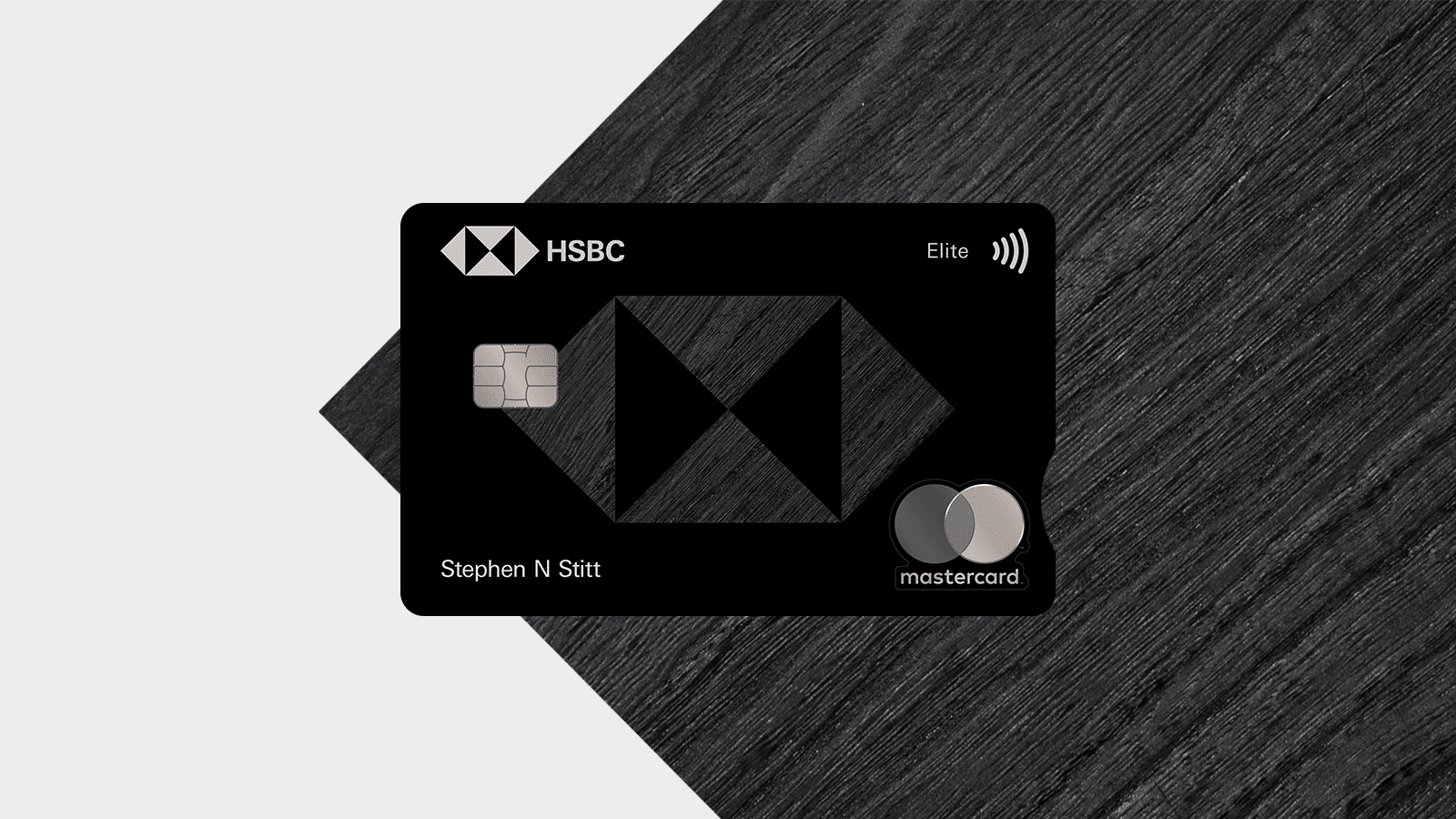

HSBC Elite credit card offers convenience, security and financial versatility for your users.

HSBC Elite

3X points on travel purchases 1X points on all other purchasesThe HSBC Elite Credit Card is a premium option tailored for individuals seeking luxury travel benefits, elevated rewards, and exclusive perks. With impressive earning rates on travel and dining, along with access to elite services, this card is perfect for those who value experiences and convenience.

From earning triple rewards on travel to enjoying VIP airport lounge access, the HSBC Elite Credit Card redefines premium credit card benefits. With a host of features that cater to frequent travelers and high spenders, it’s a reliable companion for those with sophisticated tastes.

Elevated Rewards for Travel and Dining

The HSBC Elite Credit Card offers a robust rewards structure:

- 3X points on travel purchases, including airlines, hotels, and car rentals.

- 2X points on dining and entertainment.

- 1X points on all other purchases.

These points can be redeemed for a wide range of rewards, including travel, gift cards, and statement credits. HSBC’s travel portal enhances flexibility, making it easy to plan your next adventure.

Cardholders also enjoy a $400 annual travel credit, which can be applied to airline tickets, hotels, or other travel expenses. This feature significantly offsets the card’s annual fee and adds tangible value to your spending.

Luxurious Perks for Global Travelers

The card includes Priority Pass™ Select membership, providing unlimited access to over 1,300 airport lounges worldwide. Additionally, cardholders benefit from travel insurance, purchase protection, and concierge services, ensuring peace of mind wherever you go.

With no foreign transaction fees, the HSBC Elite Credit Card is a cost-effective option for international travel.

Pros and Cons

Pros

- Elevated rewards on travel (3X) and dining (2X).

- $400 annual travel credit, offsetting the annual fee.

- Priority Pass™ Select membership for lounge access.

- No foreign transaction fees.

- Extensive travel insurance and concierge services.

Cons

- Requires excellent credit for approval.

- High annual fee, making it less accessible to budget-conscious users.

- Rewards are most valuable for frequent travelers and high spenders.

How Do I Know If the HSBC Elite Credit Card Is the Best Credit Card for Me?

The HSBC Elite Credit Card is ideal for frequent travelers and individuals seeking luxurious perks. If you value travel credits, lounge access, and elevated rewards on travel and dining, this card is an excellent choice.

However, if you’re not a frequent traveler or don’t plan to use the premium perks, other cards with lower annual fees may better suit your needs. The HSBC Elite Credit Card is best for users who can fully utilize its luxury benefits.

Why Do We Like This Card?

We like the HSBC Elite Credit Card for its focus on travel and premium perks. The combination of elevated rewards, a $400 annual travel credit, and Priority Pass™ membership makes it a standout option for global travelers.

You will remain on the current site